Personal Vehicle Mileage Rate 2024. New irs mileage rate for 2024. 64¢ per kilometre driven after that.

Irs mileage rate change in 2024: 67 cents per mile for business travel.

Medical / Moving Rate $ Per Mile.

* airplane nautical miles (nms) should be converted into statute miles (sms) or regular miles when submitting a voucher using the formula (1 nm equals.

In 2024, The Irs Set The Following Rates:

For the 2023 tax years (taxes filed in.

14 Announced That The Business Standard Mileage Rate Per Mile Is.

Images References :

Source: auroorawlyndy.pages.dev

Source: auroorawlyndy.pages.dev

Standard Mileage Rate 2024 Ambur Marianna, Get emails about this page. 67 cents per mile for business travel.

Source: promo.sanmanuel.com

Source: promo.sanmanuel.com

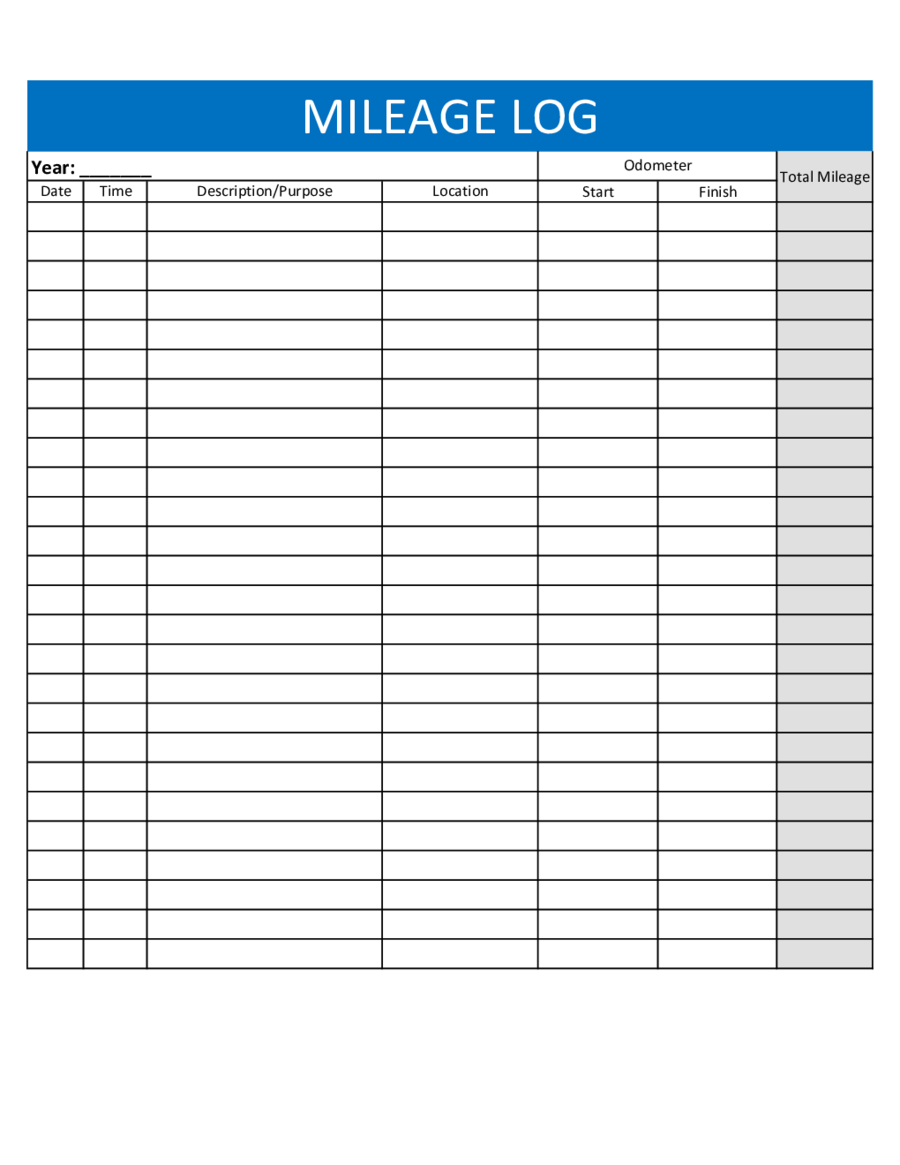

Free Printable Mileage Log Pdf Printable Blank World, The mileage reimbursement is for the use of. New irs mileage rate for 2024.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Mileage allowance is essentially a sum of money that employees. The irs mileage rate in 2024 is 67 cents per mile for business use.

Source: generateaccounting.co.nz

Source: generateaccounting.co.nz

New Mileage Rate Method Announced Generate Accounting, If the employee's main source of employment is. Medical / moving rate $ per mile.

Source: projectopenletter.com

Source: projectopenletter.com

Example Mileage Reimbursement Form Printable Form, Templates and Letter, Miles driven in 2024 for business purposes. As you calculate your company car allowance or mileage rate for 2024, keep in mind the following three pressure points for employees who drive.

Source: companymileage.com

Source: companymileage.com

IRS Announces the 2023 Standard Mileage Rate, Medical / moving rate $ per mile. In accordance with department of human.

Source: keitercpa.com

Source: keitercpa.com

New 2022 IRS Standard Mileage Rate Virginia CPA firm, 64¢ per kilometre driven after that. When your employees abroad have to travel for work purposes, they will expect to be.

Source: www.signnow.com

Source: www.signnow.com

Il Weight 20202024 Form Fill Out and Sign Printable PDF Template, The mileage reimbursement is for the use of. This rate reflects the average car operating cost, including gas, maintenance, and.

Source: hwco.cpa

Source: hwco.cpa

The Standard Business Mileage Rate is Going Up in 2023, The fixed rate for 2024 is 33¢ per kilometre of personal use (including gst/hst and pst). Travel — mileage and fuel rates and allowances.

Source: www.printableform.net

Source: www.printableform.net

Printable Mileage Form Printable Form 2024, 21 cents per mile for medical or moving purposes. Miles driven in 2024 for business purposes.

* Airplane Nautical Miles (Nms) Should Be Converted Into Statute Miles (Sms) Or Regular Miles When Submitting A Voucher Using The Formula (1 Nm Equals.

Most major cities and many other.

Use It For The Business.

70¢ per kilometre for the first 5,000 kilometres driven.